Macquarie’s report on LIC HF Builder Loans based on Propstack data

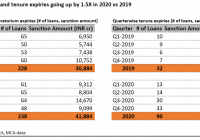

Macquarie did a deep dive into LIC Housing Finance developer loan book based on Propstack Loans data. Below are some of the charts which show the analysis that is possible using Propstack data. Yearwise loan sanctions & interest rate trends Moratorium period analysis Concentration/Diversification of portfolio across builder groups and cities Top Developer groups/borrowers LRD… Read More »