In a big boost to project loans in the commercial real estate sector, the Reserve Bank of India on 6th Feb 2020 announced its decision to extend date of commencement for these loans by a year without downgrading asset classification.

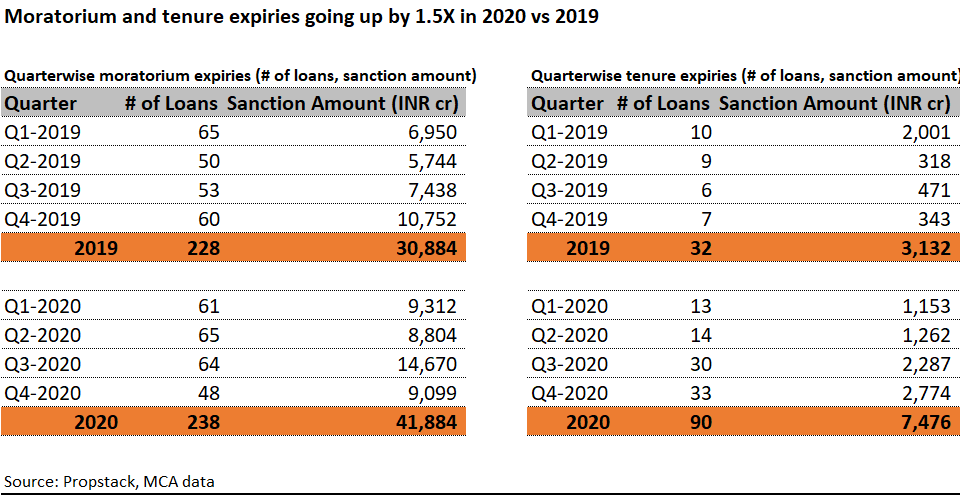

Propstack estimates that moratorium period for ~US$ 6 bn (INR 41,884 cr) of loan sanctions were coming to an end in 2020. Developers have to start principal repayment post the moratorium period and without this announcement, we would definitely have seen a surge in non performing loans (NPL’s) in the developer loan segment as many developers whose projects are stuck/delayed would not have been able to make the principal/interest repayments.

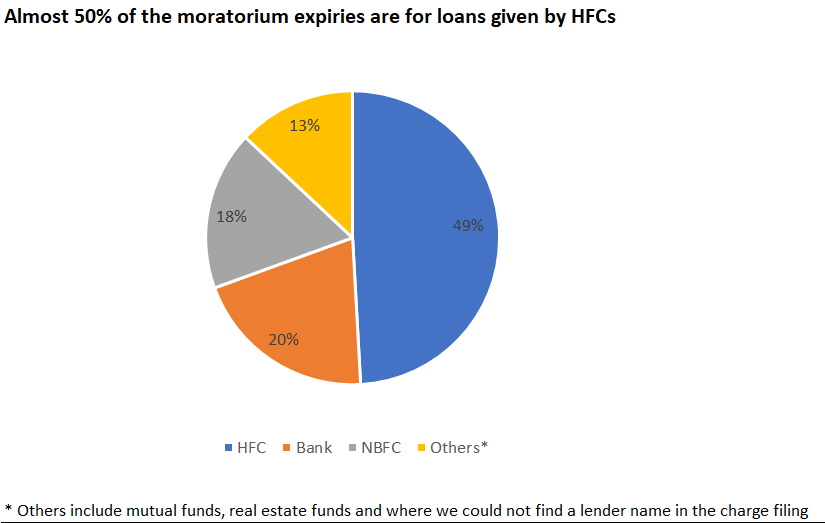

It is interesting to note that ~50% of the US$6 bn moratorium expiries are for loans given by HFCs (Housing finance companies), followed by 20% of banks and 18% for NBFCs. So this will provide a larger relief to HFCs than NBFCs.

Propstack data also shows that loan sanctions worth US$ 7bn (INR 49,360 cr) have either moratorium expiring or tenure expiring in 2020 vs US$ 4.8bn (INR 34,017 cr) in 2019. RBI’s move is a big relief for the sector without which the sector was heading towards much more challenging times in 2020