Lending fintech NBFCs have grown aggressively in the last two years as they have gone after markets which were traditionally unbanked and were able to raise a combination of equity and debt funding.

We analysed borrowings of leading Fintech players in the country basis the charge filing data available on MCA which we collate in our product Loanfeeds.

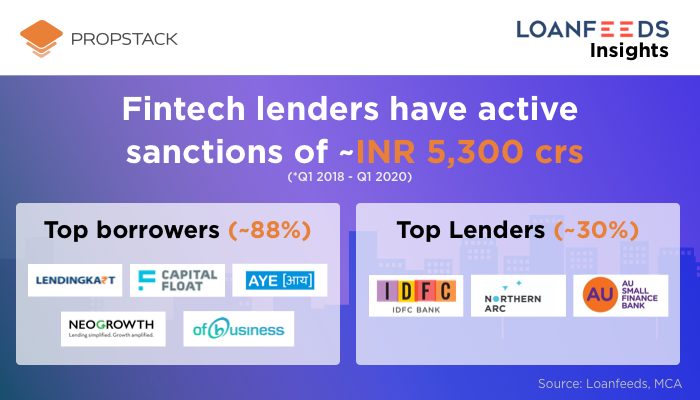

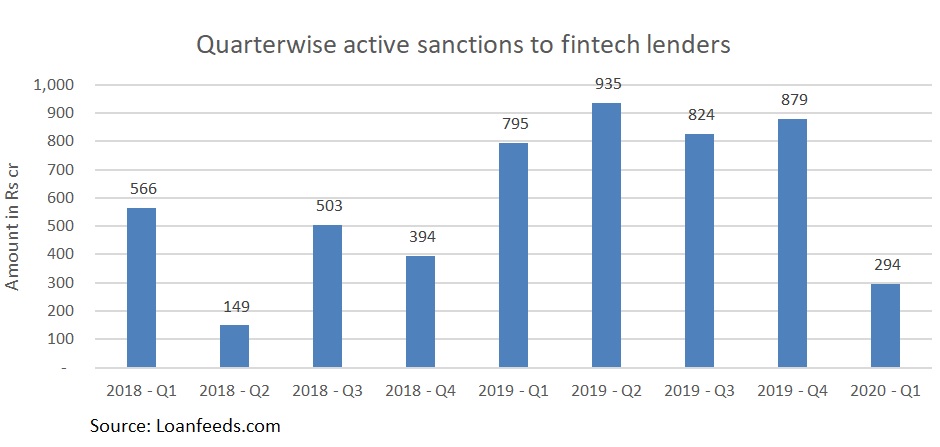

In the period Q1 2018-Q1 2020 (last 9 quarters), fintech lenders have active sanctions of INR 5,300 crs (outstanding amount could be lower). Top Borrowers are Lendingkart, Capital Float, Aye Finance, Neogrowth and Ofbusiness as they contribute to 88% of the sanctions.

An analysis of top lenders to these fintech players show that IDFC Bank, Northern Arc Capital and AU Small Finance as top lenders contributing to ~30% of the total sanctions.

We also see a lot of international impact investors are also active in lending to fintech players. Some of these names are Blue Orchard Mircofinance Fund (Switzerland), Netherlands Development Finance Company (FMO), PROPARCO (France), Caspian Impact Investment (india).

For details of each of these loans, you can visit Loanfeeds– a platform which makes discovery of secured corporate lending easy!