The Union government announced the setting up of the INR 25,000 cr AIF to revive the stalled projects across the country last week.

We at Propstack did a detailed analysis of 10,000+ RERA registered projects in MMR to get an understanding of the projects which are stalled (<5% progress in last 2 years) and are at advanced stage of construction/last mile (>70% complete). Our key findings are below:

- Total RERA registered residential projects in MMR: 7,000+

- Since each RERA project can have multiple towers, the total residential towers/buildings: 16,300+

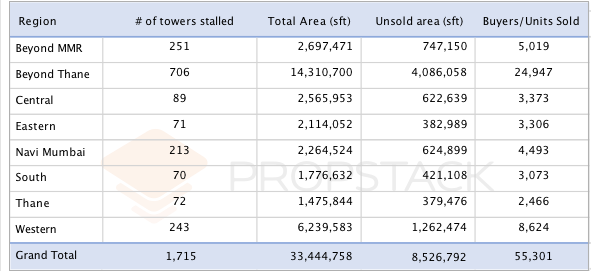

- Total towers which are stalled in last mile: 1,715 ~ 10% of the towers

*We believe the fund will have to evaluate the project tower wise given that there could be projects where there are multiple towers at different stages of construction. The fund will have to prioritize towers which are close to completion.

- Total area of these projects is 33.4 mn sft of which ~25% of the area is unsold (~8.5 mn sft)

- Majority of the projects (60%) are in the affordable and middle income housing segment (Thane, Beyond Thane, Beyond MMR) and they would also fall under the ticket size of <INR 2 cr as approved by the Union Cabinet

- There are 55,000 buyers across all these towers who are stalled in these projects and are awaiting completion of these projects

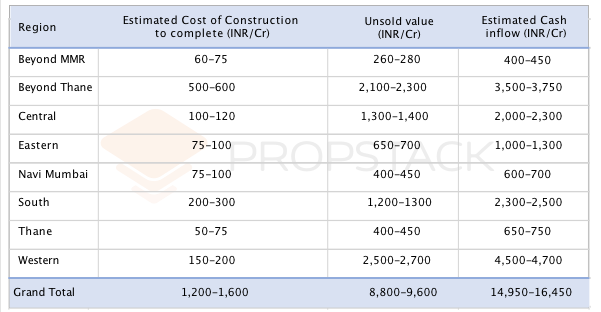

- We estimate that additional cost of construction to complete all these stalled projects is INR 1,200-1,600 crs. The good part is that the receivables from the contracted sales itself could fetch close to INR 4,000-5,000 crs.

*We have taken average construction cost of affordable housing at INR 1,200-1,500/sft and for other projects at INR 2,000-3,000/sft. We have not taken sales & marketing costs, interest costs, debt repayments into account.

- The unsold portion in these projects can fetch and additional ~INR 9,000 crs

*We have assumed average locality pricing for sale price

*The Estimated Cash Inflow is a sum of Unsold Value & Pending receivables of already sold flats.

We have done this analysis basis the project wise/tower wise data with the following fields:

Project name, Date of completion, % completion, total area (configuration wise), total sold area (configuration wise), pincode (locality), estimated additional cost of construction, estimated receivables from sold area, estimated sales for unsold area

In case anyone is interested in this data, please email us at sales@propstack.com