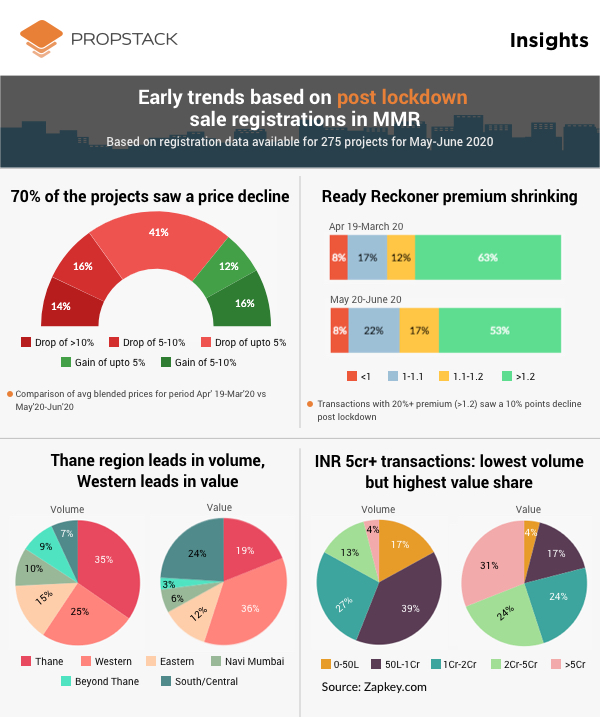

We analysed early trends emerging from ~600 sale registrations available for 275+ projects in post lockdown period (May-June 2020) in MMR (Mumbai, Navi Mumbai, Thane). Some of our key findings are:

* 70% of the projects saw a price decline

41% of the projects showed a decline of 0-5% and 14% of the projects showed a fall of more than 10% in prices. It was interesting to see that we saw some kind of a price increase for 28% of the projects.

The price comparison was done for the period Apr’19-Mar’20 vs May’20-June’20. We have taken into consideration average blended prices (includes base price, floor rise, PLC etc) for comparison.

* Ready reckoner premium shrinking

We saw that there was a 10% points decline in transactions that happened above 20%+ premium to ready reckoner rates. The % of transactions happening below the ready reckoner rates remained the same at 8%.

* Thane leads in volume, Western leads in value

Thane contributed to 35% of the volumes followed by Western region with 25%. However from a value perspective, Western led with a share of 36% compared followed by South/Central with 24%.

* INR 5 cr+ transactions: lowest volume but highest value

4% of the transaction volumes were in the ticket size of >INR 5 cr but they contributed to a value market share of 31%. The largest volume categories were INR 50 L-1 cr with 39% followed by INR 1 cr- 2 cr with 27% share.

For details related to project specific trends or other details, please reach out to sales@propstack.com