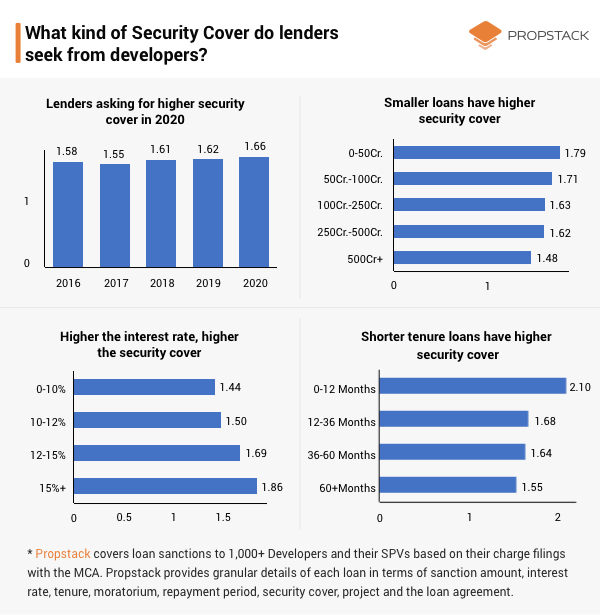

Our analysis of security cover of developer loans shows that lenders are seeking higher security from developers in the backdrop of rising risk.

Some key takeaways:

- Security cover has been rising since 2017 when it was 1.55 X to 1.66 X in 2020. This is inline with the rising risk associated with the sector.

- The security cover was large loans (>500 cr) is 1.48 X which is a 20% discount to average security cover of 0-50 cr loans. The reason for this could be that large loans are taken by larger developers and the risk weightage for larger developers may be lower compared to smaller developers.

- For high interest rates (>15%) the security cover is 1.86 X which is a premium of 30%+ over loans at interest rates of <10% (which are largely lease rental discounting loans).

In case you are interested in knowing details of all developer loans, please register here.