The Peripheral Business Districts (PBDs) have always been a choice for companies looking for large affordable spaces.

Central Business District (CBD) locations – which have been the hub of business activity have mostly been touted as the costliest locations for commercial leasing.

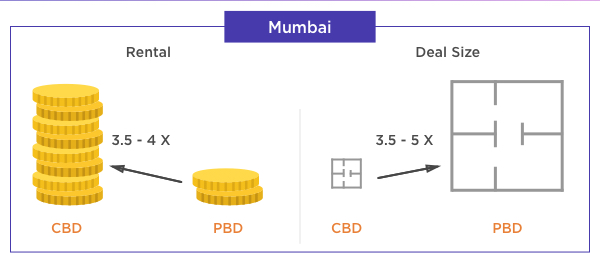

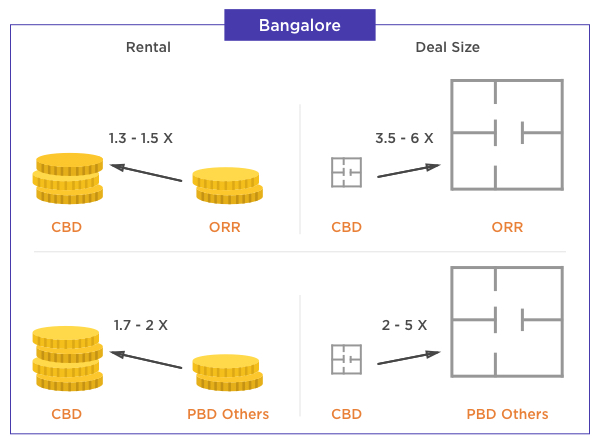

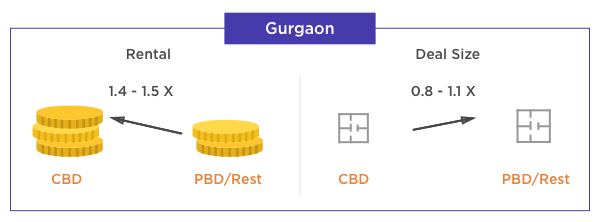

We tried to compare the rental difference between CBD and PBD micromarkets for 3 major cities of India. Since PBD are also known for large space take-ups, the variance in average deal size between these markets was also analysed.

Mumbai CBD rentals were 3.5-4 times higher than those of PBD despite the emergence of some suburban locations as major corporate hubs. The scenario was exact reverse in deal size with PBD micromarkets having 3.5 -5 times the deals compared to CBD.

For Bangalore, the locations along Outer Ring Road (ORR) and other PBD locations were compared to CBD. ORR micromarkets indicated the highest deal size of about 3.5 to 6 times CBD micromarket due to the presence of a large number of SEZs along the stretch.

In terms of rental comparison, CBD was almost 1.7 to 2 times rent commanded by other PBD locations while the rental difference narrowed to maximum 1.5 times for locations along Outer Ring Road due to the presence of good quality projects along the stretch.

In Gurgaon the difference between CBD and PBD locations (Rest of Gurgaon) was just 1.4-1.5 times. This might be attributed to smaller geographical expanse under consideration.The deal size was same in both the micromarkets.

In our view, geographical expanse and quality of projects both play a considerable role in determining the rental difference between CBD and PBD locations. PBD locations always enjoy larger average floor plates and thereby deal size due to the expanse available.

*Grade A data only and Includes renewals

To get more CRE market insights login to www.propstack.com