Propstack Insights: Bangalore – 9msf lease expiries in 2017

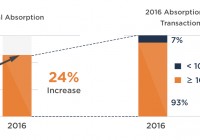

Total volume of Lease expiries in Bangalore is expected to cross 9 msf in 2017. Witnessing quarterly increase since beginning of year, total area of lease expiries in Q4 2017 is expected to be above 3 msf. The 200+ leases expiring in 2017 have average monthly rent of INR 57/sf/month and add upto nearly 56 crores… Read More »